Q3FY21 Consolidated Revenue from Operations stands at Rs. 185.95 crores, Consolidated PAT stands at Rs. 56.42 crores

Chennai: February 11th, 2021: Computer Age Management Services Limited (“CAMS”), a leading Registrar & Transfer Agent to Mutual Funds has announced its financial results for the third quarter ended on 31st December, 2020.

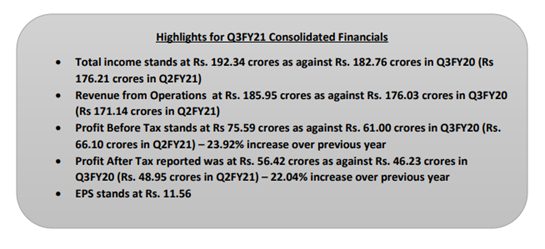

Q3FY21 (Consolidated)

Revenues from operations for the third quarter ended December 31st, 2020 (Q3FY21) stood at Rs. 185.95 crores as compared to Rs. 176.03 crores in Q3FY20 (Rs. 171.14 crores in Q2FY21). Likewise, the Total Income stood at Rs.192.34 crores in Q3FY21 as against Rs. 182.76 crores in Q3FY20 (Rs. 176.21 crores in Q2FY21).

Profit Before Tax (PBT) stood at Rs. 75.59 crores for Q3FY21 as compared to Rs 61.00 crores in Q3FY20 (Rs 66.10 crores in Q2FY21). The Company’s PBT margin stood at 39.30%

Profit After Tax (PAT) reported at Rs. 56.42 crores for Q3FY21 as against Rs. 46.23 crores in Q3FY20 (Rs. 48.95 crores in Q2FY21). The Company’s PAT margin stood at 29.33%

Earnings per share (EPS) for the quarter ended Q3FY21 stood at Rs. 11.56

Q3FY21 Standalone Revenue from Operations stands at Rs. 179.57 crores, Standalone PAT stands at Rs. 74.30 crores

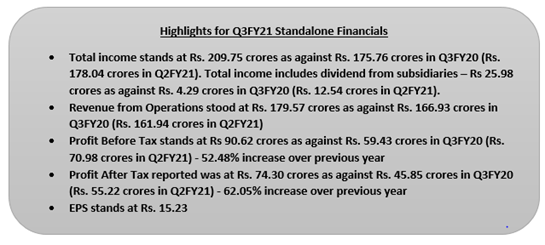

Q3FY21 (Standalone)

Revenues from operations for the third quarter ended December 31st, 2020 (Q3FY21) stood at Rs. 179.57 crores as compared to Rs. 166.93 crores in Q3FY20 (Rs. 161.94 crores in Q2FY21). Likewise, the Total Income stood at Rs.209.75 crores in Q3FY21 as against Rs. 175.76 crores in Q3FY20 (Rs. 178.04 crores in Q2FY21). Total income includes dividend from subsidiaries of Rs 25.98 crores as against Rs. 4.29 crores in Q3FY20 (Rs. 12.54 crores in Q2FY21).

Profit Before Tax (PBT) stood at Rs. 90.62 crores for Q3FY21 as compared to Rs 59.43 crores in Q3FY20 (Rs 70.98 crores in Q2FY21).The Company’s PBT margin stood at 43.20%. Profit After Tax (PAT) reported at Rs.74.30 crores for Q3FY21 as against Rs. 45.85 crores in Q3FY20 (Rs. 55.22 crores in Q2FY21).The Company’s PAT margin stood at 35.42%. Earnings per share (EPS) for the quarter ended Q3FY21 stood at Rs. 15.23

Commenting on the results, Mr. Anuj Kumar, Whole Time Director & Chief Executive Officer, CAMS Limited, said, “It has been a satisfactory quarter both from the perspective of Company results and the operations coming back to near normal as the pandemic led changes abated. MF AuM was on a stride with the market volatility settling down and peaked to historic highs. SIPs registrations have seen a come-back in the last quarter compared to the previous quarter pointing to retail investor confidence. Assets serviced by CAMS is at 69.5% of the industry AAuM.

The Company’s services for AIF and PMS segments expanded with the launch of an integrated digital on-boarding platform. CAMS digital properties like myCAMS, GoCorp and edge360 posted significant volume traction aiding the MF industry’s digital drive. There has been concerted visibility and opportunity build with wider BFSI segment for new products and new business lines which include Recon platform, Digital platform for loan against MF, CAMS Finserv Account Aggregator and CAMS Pay.